Small Business Asset Write Off 2024

Small Business Asset Write Off 2024 – Sell off as much inventory If you have a business loan, it may now be due in full. If you cannot afford to pay the loan, make whatever asset you used as collateral available to your lender. . If you decide to close your small business, you must notify the Some of these forms allow you to write off business losses associated with going out of business. Learn how to write off .

Small Business Asset Write Off 2024

Source : www.reddit.com25 Small Business Tax Deductions (2024)

Source : www.freshbooks.comVJ Accounting & Taxation Services on LinkedIn: #vj #vjaccounting

Source : www.linkedin.comAustralian Federal Budget 2023 2024 Key Tax Measures and Instant

Source : www.lexology.comPlatinum Accounting & Taxation | Melton VIC

Source : www.facebook.comMalcolm Roberts 🇦🇺 on X: “One Nation supports fundamental

Source : twitter.comOptimal Chartered Accountants | Maryborough QLD

Source : www.facebook.comVJ Accounting & Taxation (@VJaccountingTax) / X

Source : twitter.comNorth Coast Accounting | Perth WA

Source : m.facebook.comSignificant changes to temporary full expensing and instant asset

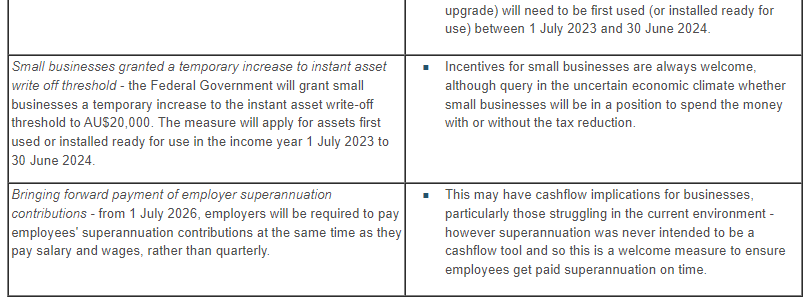

Source : www.causbrooks.com.auSmall Business Asset Write Off 2024 Small Business $20,000 instant asset write off, is it bad or good : The federal government should expand the instant asset write off to cover assets worth $150,000 the Council of Small Business Organisations Australia (COSBOA) says in its 2024 pre-budget . The instant asset write-off threshold, which the federal government while extending its partner program, the Small Business Energy Incentive, to at least 30 June 2025. The latter program .

]]>